06 November 2023

Keep your inflation promise by freezing alcohol duty, businesses tell Chancellor

- Representatives of more than 400 businesses write to Chancellor demanding alcohol duty freeze in autumn statement

- Call comes amidst fears of a further tax hike following 10.1 percent duty increase in August – found by ONS to have caused largest contribution to UK inflation from alcohol on record

- Chancellor urged to back UK businesses.

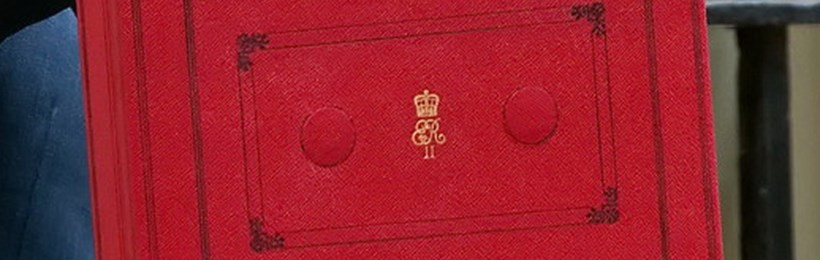

Businesses have urged Jeremy Hunt to keep his promise to halve inflation by cancelling the planned increase in alcohol duty in his autumn statement.

In an open letter, the Scotch Whisky Association (SWA), UK Spirits Alliance (UKSA), English Whisky Guild and Wine & Spirits Trade Association (WSTA) have warned the Chancellor that a further increase in alcohol tax will irrevocably harm British businesses, including those in the hospitality sector. The organisations represent more than 400 drinks producers across the country.

Excise duty on alcohol was increased by 10.1 percent from 1 August, and The Office for National Statistics has concluded the increase caused the largest rise in UK inflation on record (see notes).

The groups have warned a further tax hike would stoke inflation, which Mr Hunt and the Prime Minister pledged to halve by the end of the year.

Three quarters of the cost of a bottle of whisky or gin is currently claimed in tax, with spirits generating a third of all alcohol sales in restaurants, pubs and bars.

Mark Kent, Chief Executive of the Scotch Whisky Association, said:

“Raising alcohol duty in August was a mistake the Chancellor shouldn’t repeat in November. Distillers fear a further tax increase, the impact of which won’t just be felt by drinks producers but by the businesses they support and ultimately by consumers. Mr Hunt has promised to lower inflation and to help deliver on that promise he needs to rule out any further increase to alcohol duty.”

Miles Beale, Chief Executive of the Wine & Spirits Trade Association, said:

“After the largest tax rise in almost 50 years on alcoholic drinks in August, the Chancellor should rule out any further rises in this Parliament. Any further increase would undermine the Government’s own priority of bringing inflation under control. The damage done by August’s hikes are clear: they have stoked inflation, pushed up prices for cash-strapped consumers and damaged British businesses all across the hard-hit alcoholic drinks and hospitality sector, including distillers. A second alcohol duty rise would be self-defeating and could prove the final nail in the coffin for some British drinks businesses.”

Stuart Eke, Chairman of the UK Spirits Alliance, said:

“The Chancellor should use his autumn statement to back a world-renowned domestic industry. But if that isn’t a good enough reason to freeze alcohol duty, then he should be reminded of what the ONS said about the duty increase in August and rule out a further tax hike that will simply stoke inflation and hurt business.”

Morag Garden, Chief Executive of the English Whisky Guild, said:

“The Governments support is needed to help protect and boost the homegrown spirits industry that is creating jobs in regions throughout the UK, delivering investment into our communities, and taking brand UK across the world through our export lead growth agenda. We want the Chancellor to deliver this support by using his Autumn statement to freeze duty for spirits. A further tax hike will only hurt an industry looking to grow and households struggling with rising costs.

ENDS